FirsToken™

Our Tokenization as a Service (TaaS) enables merchants and service providers to accelerate PCI Compliance by reducing scope and costs.

Accelerating your PCI Compliance: Reduce Scope and Cost

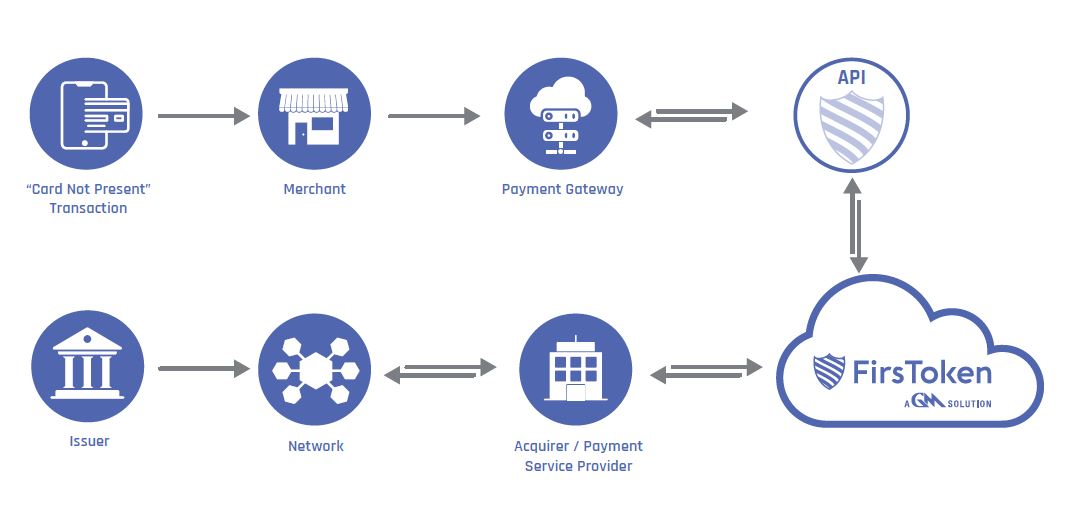

Our simple, secure token vault solution is designed to facilitate PCI compliance and is tailored to the needs of “Card Not Present” merchants. FirsToken™ helps service providers offer additional payment functionality and meet the needs of their merchants as transaction volume grows, leading to higher satisfaction and loyalty.

Our preferred descoping technique is to remove sensitive data from your internal systems, exchange it for a nonsensitive placeholder, and then store it safely outside of your environment—minimizing your PCI footprint without disrupting ongoing business operations.

Reduce Risk to Strengthen Cyber Policies

Protecting your organization’s reputation in a world of ever-increasing cyber risk is critical. By removing sensitive data from your environment and storing it externally, your organization can safely and confidently control your risk exposure, measurably lower your premiums, and simplify compliance with international regulations. As a result, you can potentially improve your insurability by demonstrating your organization’s commitment to reducing cyber risk.

Cloud Based

- The flexible, scalable token vault solution for processors, gateways, and banks

- No need to build your own platform – developer-friendly APIs with 24/7/365 support

- Built on AWS for enterprise-grade security, high availability, and automatic scaling

Open Use

- Independent token vault offers maximum flexibility across platforms and schemes

- Token and PAN are stored in the cloud and can be used on any platform

- Firstoken lets you own the token and be in control

Built & Supported By Experts

- The GM Sectec team of security experts have a deep history of innovation and outstanding support

- Trusted by thousands of merchants, processors, gateways, and banks in 50+ countries

- Accelerate PCI Compliance by reducing scope and costs

Accelerate your journey to PCI Compliance by reducing scope and not storing sensitive information. Leave your PCI Cetification on us!

- Streamlined token solution to bundle with your core offering

- Enable frictionless, 1-click customer experience to boost conversion rates and repeat purchases

- Tokenization automatically scales as merchants’ volumes increase

- Safeguard customer data and reduce the risk of data breaches

- Reduce time to achieve PCI Compliance

The Industrial Strength Token Vault

- Captures sensitive data via API, batch, or third-party requests

- Returns a non-sensitive, multi-use token that can be safely stored within business systems while the original data is secured externally

- Transmits sensitive data safely to multiple partners, processors, gateways, and other third-party providers

- Token and PAN stored in the cloud

- PCI-DSS Level 1 Certified

- 200 millisecond response per request

- Perform authorizations from the web interface, batch, iFrame or via API

- Helps meet Requirement 3.4 of the PCI-DSS standard

- Web portal supports tokenization/detokenization, transaction authorizations, and activity reports

- Integration via API for the automation of processes on the customer side

- Developer Tools including APIs and iFrame to capture card data

- Compatible with all browsers and mobile operating systems

"Recently we tightened our cooperation in Europe and Africa, we treat GM Sectec as our partner, not only in PCI Compliance, but all IT-security related areas."

Szymon Jazy Global Information Security Officer PayU